Verity Notes

Verity Capital offers one of the largest universes of Structured Notes.

Verity Notes are securitised investment solutions which represent an attractive alternative to a direct investment in financial assets such as equities, indices, bonds, commodities, interest rates and currencies.

Our clients can choose from 90 different payoffs offered on a multi-issuer platform with up to 10 different issuance entities. Our system accesses over 1,900 equities and around 150 indexes and exchange-traded funds as well as around 400 credits, interest rates and major currencies and commodities as underlying assets.

Our partner technology platform allows us to instantly calculate complex structures even when tailored to individual client needs and to produce all necessary documentation automatically in four languages. It operates more than 39,000 new issuances and more than 124,000 secondary market transactions per year.

Our offering

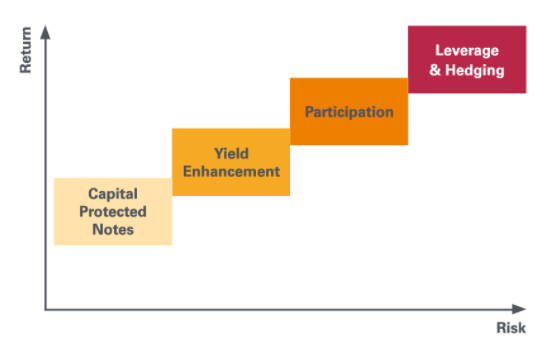

Our Verity Notes offerings can be grouped into four main categories: capital protection, yield enhancement, participation and leverage & hedging. We offer our clients a variety of different payoffs that are all managed on our own platform, enabling us to react efficiently and quickly to changes in demand.

Lifecycle Management

We offer services throughout the entire lifecycle of our products.